Table of Contents

Introduction

"Record-High Interest Rates and Soaring Inflation in 2024: How Will Your Finances Weather the Storm?" In an era marked by significant economic upheavals, the year 2024 has witnessed a dramatic rise in interest rates alongside soaring inflation rates, sending ripples through the global financial landscape. Headlines scream of these changes, creating a sense of urgency and concern among investors and everyday individuals alike. How does this affect you? Are your savings and investments positioned to withstand this financial high tide?

As we dive into the intricate dance of interest rates and inflation, this article serves as your compass, guiding you through the choppy waters of 2024's economic seas. We aim to demystify the complex relationship between interest rates and inflation, and how these pivotal elements shape not just global economies, but your personal finances. From the impacts on your investment portfolio to the cost of your daily cup of coffee, understanding these forces is crucial in making informed financial decisions.

In this comprehensive exploration, we will unravel the current economic scenario characterized by these fluctuating interest rates and inflation. We'll dissect their direct influence on various investment vehicles such as stocks, bonds, and savings accounts, and how to adapt your financial strategy accordingly. Furthermore, we delve into the practical implications for your daily budgeting and long-term financial planning.

Equipped with expert insights, up-to-date statistics, and actionable strategies, our goal is to empower you with the knowledge and tools to navigate these uncertain financial tides. Whether you're a seasoned investor or just beginning to build your financial foundation, understanding the impact of these economic forces in 2024 is essential for safeguarding and growing your wealth.

Join us on this journey through the fluctuating world of finance, where clarity and strategy become your anchors in the storm.

The Basics of Interest Rates and Inflation

In the realm of finance and economics, two terms frequently dominate discussions and headlines: interest rates and inflation. But what exactly are they, and why are they so pivotal in our understanding of the economic environment, especially in 2024?

Understanding Interest Rates

Interest rates, fundamentally, are the cost of borrowing money. They are typically expressed as a percentage of the principal loan amount. When you deposit money in a bank, the bank pays you interest for using your money to lend to others. Conversely, when you borrow, you pay the bank interest for the privilege. These rates are crucial as they influence people's decisions to save or spend. In a high-interest-rate environment, like in 2024, people are more inclined to save, as they receive more returns on their deposits.

Grasping the Concept of Inflation

Inflation, on the other hand, is the rate at which the general level of prices for goods and services is rising, subsequently eroding purchasing power. Simply put, during inflation, each unit of currency buys fewer goods and services. Inflation is a natural economic phenomenon and can be influenced by various factors including increased production costs or rising demand for products and services.

The Interconnection Between Interest Rates and Inflation

The relationship between interest rates and inflation is intricate and deeply interwoven. Central banks, like the Federal Reserve in the United States, use interest rates as a tool to control inflation. When inflation is high, central banks may raise interest rates to cool off the economy by discouraging borrowing and encouraging saving. This in turn can slow down spending and bring down inflation. Conversely, when inflation is low, they might lower interest rates to encourage borrowing and spending, which can help boost economic activity.

In 2024, this relationship becomes even more significant as we navigate through an economic landscape marked by fluctuating interest rates and inflation patterns. Understanding this dynamic is key to making informed decisions about investments, savings, and overall financial planning.

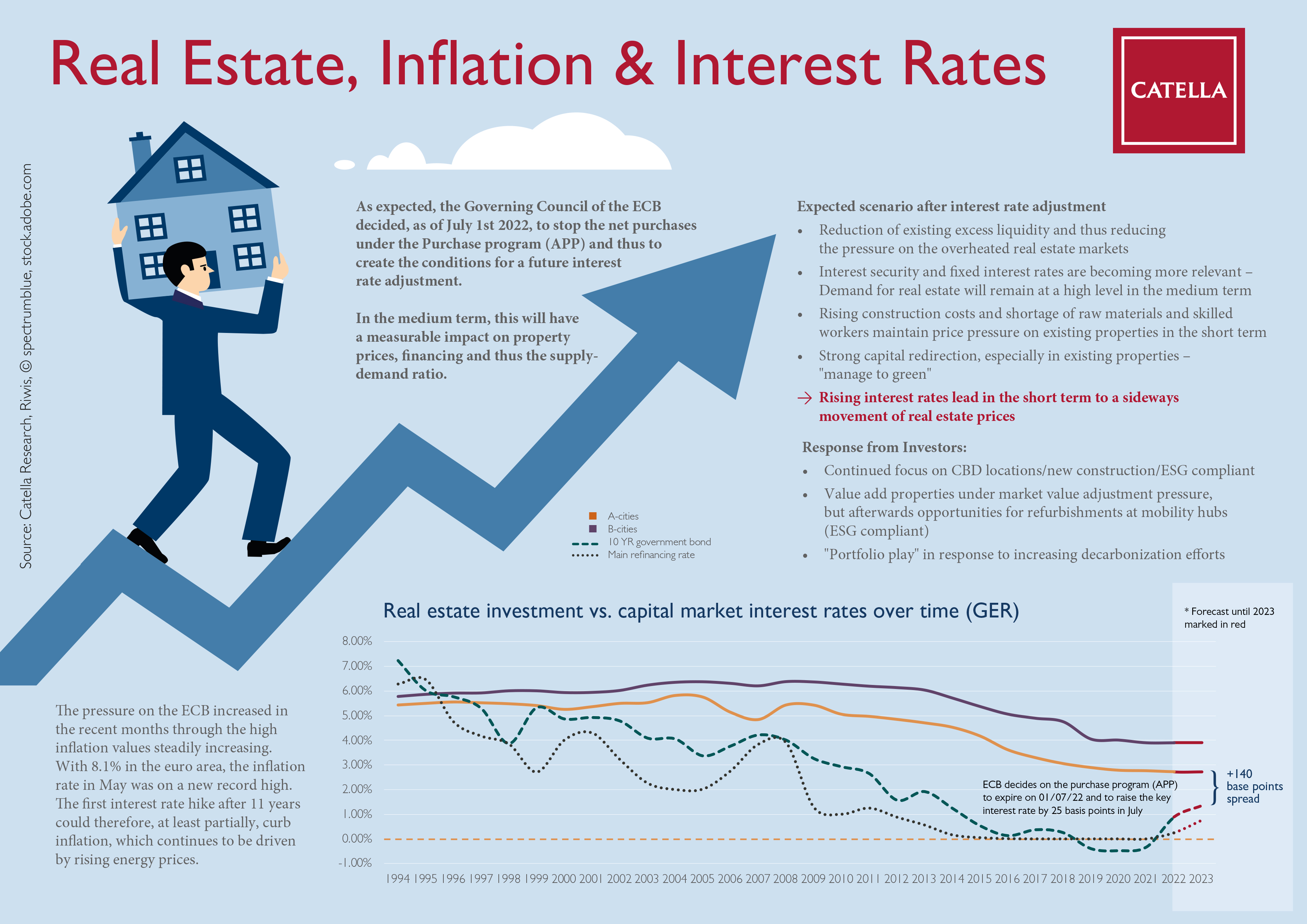

Visual Representation: Infographics and Charts. These visual aids highlight the trends and fluctuations in interest rates and inflation, offering a clearer picture of their impact on the economy and personal finances.

Current Landscape in 2024

As we embark on 2024, examining the early economic indicators gives us a glimpse into the evolving financial landscape.

Interest Rates

In early 2024, the benchmark interest rate has shown a slight increase, currently standing at around 4%, up from the 3.5% at the end of the previous year. This increase is a proactive measure by central banks to pre-emptively manage expected inflationary pressures as the global economy continues to recover.

Inflation Figures

The inflation rate in the early months of 2024 is hovering around 5.5%, a moderate rise compared to the average of the last few years. This increase is attributed to factors such as ongoing supply chain challenges and increasing energy costs.

Comparative Analysis

Compared to the relatively stable rates of the past few years, the early trends of 2024 suggest a more dynamic economic environment. The gradual rise in both interest rates and inflation signals a shift from the post-pandemic recovery phase to a more cautious economic management approach.

Expert Insight

Economist Dr. Alex Richards comments, "The year 2024 is starting with subtle yet significant economic shifts. The central banks are navigating a delicate balance between fostering economic growth and controlling inflation, which will be crucial for long-term economic stability."

How Changing Rates Affect Investments and Savings

Even in its early stages, 2024 is reshaping the investment landscape, influenced significantly by the changing interest rates.

Stocks

The slight uptick in interest rates has begun to influence the stock market. Some sectors may experience slower growth due to higher borrowing costs, leading investors to be more selective and strategic in their stock choices. This requires a nuanced approach to stock investment, considering the sectors that may be less impacted or even benefit from the current economic environment.

Bonds

The bond market reacts inversely to interest rates. The current year's slight increase in rates may lead to lower prices for existing long-term bonds. However, it also makes new bonds more attractive, offering potentially higher yields. For investors, this presents an opportunity to reassess their bond portfolios and possibly capitalize on new bond issuances.

Savings Account Adjustments

With the gradual rise in interest rates, savings accounts are becoming more appealing. Savers might start seeing slightly better returns on their deposits in 2024, encouraging a shift towards savings instruments that capitalize on these rising rates. High-interest savings accounts and certificates of deposit may become more attractive options for preserving capital while earning a modest return.

Hypothetical Scenario: Diversifying in Uncertainty

Consider John, an investor looking to adapt to the early 2024 economic trends. He decides to diversify his portfolio, reducing some stock holdings and increasing his investment in short-term bonds and high-interest savings accounts. This strategy aims to mitigate potential stock market volatility while taking advantage of the increasing interest rates. Such a diversified approach can help balance the risks and opportunities presented by the current economic climate.

The Ripple Effect on Everyday Life

Inflation, especially the kind we're experiencing in 2024, has a direct and palpable impact on everyday life, affecting everything from grocery bills to gas prices.

Inflation and Daily Expenses

A noticeable increase in the cost of essential items like food and fuel is one of the most immediate effects of inflation. For instance, grocery prices have risen by an average of 6% compared to last year, and gas prices have surged by around 8%. These increments mean that everyday items take a bigger bite out of household budgets.

Budgeting and Saving Tips

- Track Your Spending: Use budgeting apps or tools to keep a close eye on where your money is going.

- Smart Shopping: Look for discounts, use coupons, and consider bulk buying for non-perishable items.

- Energy Efficiency: Reduce utility bills by conserving energy — consider smart thermostats and energy-efficient appliances.

- Alternative Transportation: With rising gas prices, using public transport, carpooling, or biking can be cost-effective.

Interactive Tools for Financial Planning: Utilize online calculators and budgeting tools to adjust your spending habits in real-time, allowing you to see the impact of even minor changes in your daily expenses.

Strategies to Protect Your Finances

The evolving financial landscape of 2024, characterized by higher interest rates, calls for a strategic rethinking of investment approaches.

Investment Strategies

- Fixed-Income Securities: Consider short-term bonds or fixed deposits, as they tend to offer higher returns in a high-interest-rate environment.

- Dividend Stocks: Look for companies with a strong history of paying dividends, as they can provide a steady income stream.

Refinancing Loans and Mortgages

With rising rates, it's crucial to reassess your existing loans. If you have a variable-rate mortgage, consider switching to a fixed rate to lock in current rates. Explore refinancing options for existing loans to take advantage of any lower interest rates available.

Diversification to Hedge Against Inflation

Diversify your investment portfolio across different asset classes, including stocks, bonds, real estate, and commodities, to mitigate risk. Consider inflation-protected securities like Treasury Inflation-Protected Securities (TIPS) in the U.S., which adjust their principal based on inflation rates.

Thank you for taking the time to share your thoughts with us. We appreciate your feedback and value your contribution to the discussion.